Kingston finance expert shares his top tips for investment success

By Ellie Brown - Local Democracy Reporter 2nd Dec 2021

In his second Nub News blog Kingston financial planner Jason Lurie, from local firm Holland Hahn & Wills, shares the secrets to successful investing.

Read on for his top five tips on how to ensure returns over time - and learn the role that inflation plays and why this is important

Today I want to chat about taking a different approach to investing, in order to generate a mindset that allows you to never to worry about your investing returns ever again.

To me, there are 5 key concepts needed to be understood for your successful mindset:

- Risk

- Diversification

- Predictions, market timing and forecasting

- Behavioural biases

- Financial goals

We have all heard the saying 'risk and return are related', and we can easily understand that if you were to invest in a brand new, start up, unquoted company, there is a very good chance that you will lose your money, as so many start ups fail. This is what we might term 'capital at risk'.

On the other hand, keeping your money on deposit with the bank, while it offers security of your capital, over the long term brings into play perhaps the most insidious risk of all, and that is of course 'inflation'.

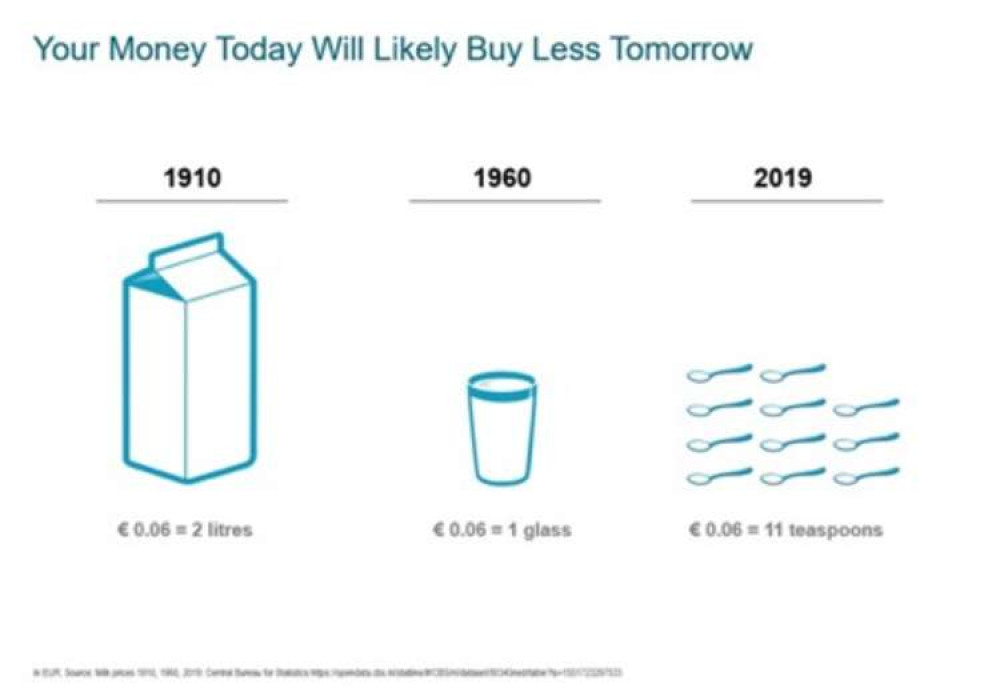

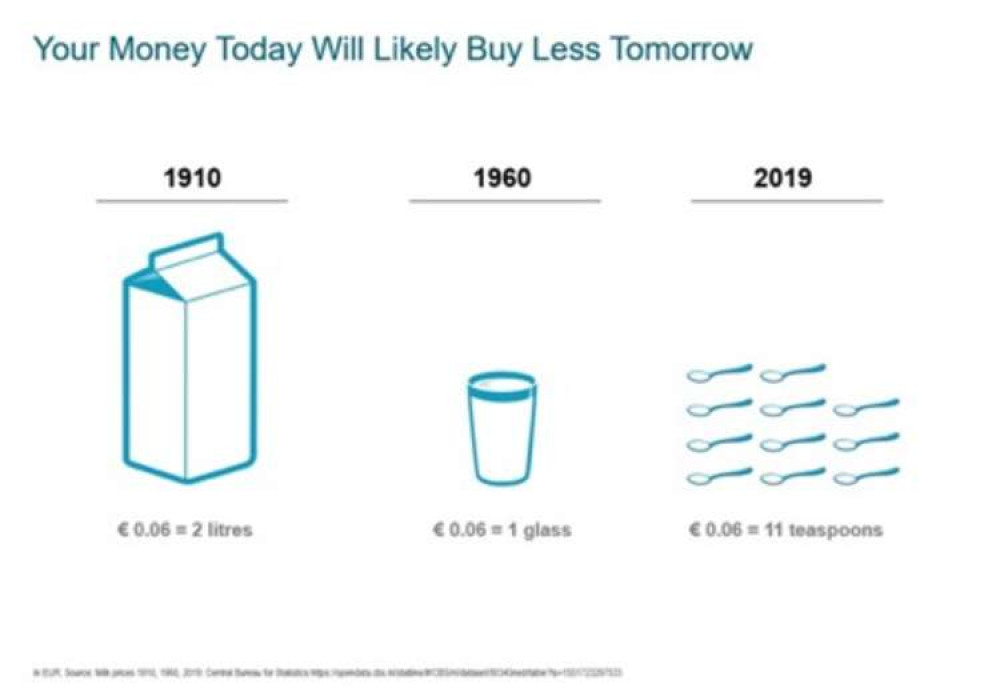

Inflation is simply a measure of the increasing cost of 'things' over time. In their recent Fireside Chat Simon and Amyr from Holland Hahn & Wills talk in an interesting way about inflation, citing the example of the changing price of milk:

In 1919 you could have bought 4 pints of milk for 7p.

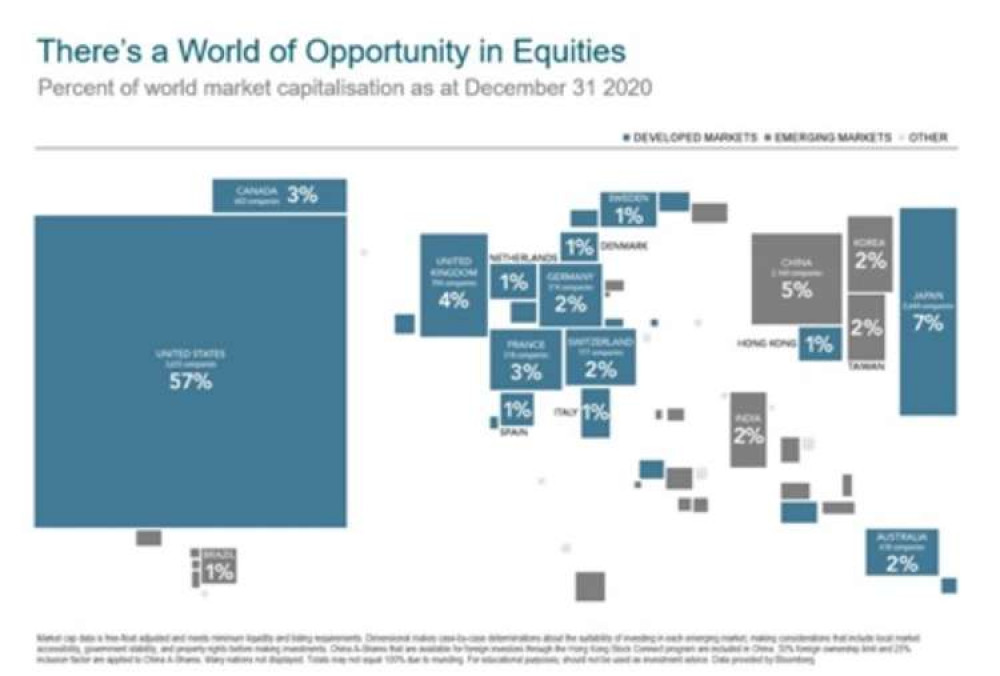

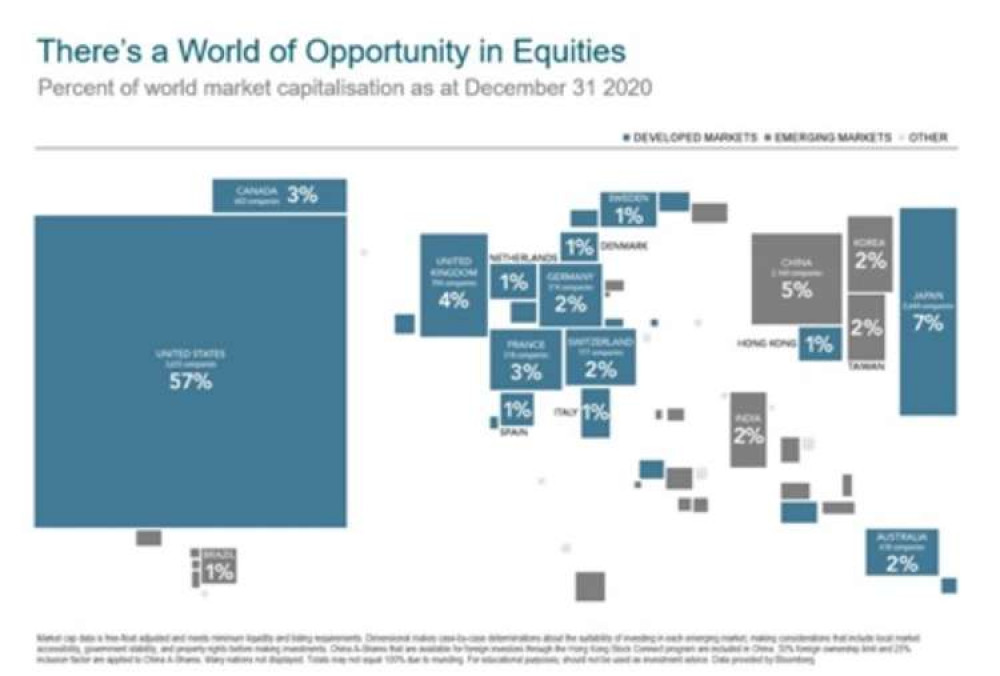

Today those 4 pints would cost you £1.50 (£1.85 for organic), more than a 20-fold increase in price. Why is this so important? Amyr points out that for an average couple today retiring at age 60, living to age 90, they have 30 years of inflation to cater for, let alone an improving lifestyle. As Amyr states "you need to be mindful of the fact that money needs to work for you pretty much as long as it took you to build that pot in the first place." Therefore, for investing success, your return over and above inflation is the most important measure to use. "Diversification is the only free lunch in investing" is a quote often attributed to Warren Buffet, otherwise known as the Sage of Omaha. It makes sense, therefore, that we should look at the globe as the potential marketplace. However, this is often not the case as most people have a heavy investment bias towards their own country. It has been empirically proven that predictions, market timing and forecasting are not successful strategies over the long term. However, there's a whole industry out there dedicated to these areas. "Why is this?" you might ask. Well, as human beings we have what are commonly termed 'behavioural biases.' We often act on impulse, selling because "I can't take this bear market any longer" or buying because "everyone else is making money, I want some of the action." In fact, this behavioural bias is so strong that that we actual term it, FOMO (Fear of missing out). So how do we succeed in investing in the face of such uncertainty and behavioural biases? This is how:1) Risk - Separate your money into the amount you need to spend over the short term and place it on deposit so that your capital is protected. Over the short-term inflation is unlikely to be a major factor. For the balance accept a varying capital value because it's long-term investment; and buying publicly shares in companies listed in a recognised stock exchange is one of the few methods that beats inflation long term.

2) Choose as globally diversified strategy as you possibly can. There are plenty of funds out there that invest widely and cheaply, which will do the heavy lifting for you.

3) Do not listen to the newspaper pundits, experts, predictors or your friends down the pub, club, etc. As Simon says, "Journalists need to write articles once a week or once a day" and they can't write about the same thing every day, therefore they tend to make predictions (but they also tend to forget the ones very quickly that were wrong).

4) Understand that we do have behavioural biases so don't let FOMO rule your life.

5) Have a financial plan – with a financial plan you will set realistic financial goals, you can measure your returns against what's really important, namely inflation, and what you actually need to achieve in order to maintain your lifestyle and to have a fulfilling life.

At Holland Hahn & Wills, we always begin by creating a bespoke financial plan for each client, because only with a robust, well thought out, financial plan can you set realistic financial goals, invest your money wisely, and close your ears to noise, predictions, plus emotional and behavioural biases that can only hamper your investment success.

If you have questions or comments I'd love to hear them, please feel free to contact me on 020 8943 9229, or via email at [email protected]

If you want to know more about this area or perhaps want a second opinion on the way your own wealth is managed, we'd be delighted to have a conversation with you.

You can visit our website at www.hhw-uk.com.

Feel free to share this article with a friend.

This article is for information purposes and should not be treated as advice. Individual circumstances should always be considered prior to purchasing any financial products. For further information please contact your Wealth Planner.

Any views expressed above are based on information received from a variety of sources which we believe to be reliable, but are not guaranteed as to accuracy or completeness. Any expressions of opinion are subject to change without notice. Past performance is not a reliable indicator of future results. Investing involves risk and the value of investments and the income from them may fall as well as rise and is not guaranteed. Investors may not get back the original amount invested.

About Jason

Jason first started advising clients in 1983 and is a Chartered Financial Planner and Wealth Manager.

He has been a partner at Kingston financial planning firm Holland Hahn & Wills since 2003.

The father-of-two lives in Weybridge and in his spare time is a keen member of Surbiton Golf Club.

Find out more about Kingston Nub News sponsors Holland Hahn & Wills HERE.

CHECK OUT OUR Jobs Section HERE!

kingston vacancies updated hourly!

Click here to see more: kingston jobs

Share: